Read this article in Français Deutsch Italiano Português Español

Boom in US LNG exports to Europe could be temporary, study shows

January 09, 2023

(Graph: IEEFA.)

(Graph: IEEFA.)

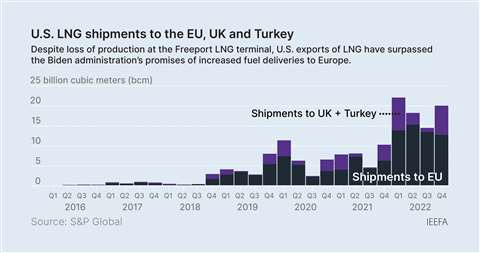

The Russian invasion of the Ukraine has disrupted the traditional flows of gas into Europe and led to a surge in LNG exports from the U.S. But those gains could be short-lived as Europeans have learned to cut demand for gas, use its fuels more efficiently and boost substitutes, a recent study has shown.

The study from Institute for Energy Economics and Financial Analysis (IEEFA) noted that LNG exports from the US to the EU were less than 22 billion cubic meters of LNG in 2021. Full-year data for 2022 is not available, but the institute estimated that exports from the US to EU will likely surpass 55 bcm in 2022. Those exports could climb further once shipments to the UK and Turkey are added. U.S. LNG shipments to greater European gas markets could reach 75 bcm in 2022, up from 44 bcm a year prior.

LNG shipments from the US to Europe will likely increase further in 2023. The Calcasieu Pass LNG plant in Louisiana was ramping up exports at the beginning of 2022. Now that the plant is operating at full capacity, we could see its annual shipments to the EU rise by 4 to 5 bcm in 2023.

The growth in LNG exports to Europe would likely have grown further if the massive Freeport LNG plant had not shut down in June 2022 in response to a major explosion. At the time, the plant represented nearly 20 % of the total US liquefadtion capacity. It has taken longer than initially expected to bring the plant online again and its status makes it a “wildcard” when predicting US capacity for 2023.

“It’s taken far longer than expected to get the plant up and running again, and federal regulators recently asked the company to resolve a long list of issues before the plant can reenter service. But if the plant resumes operation in the second quarter of 2023, it could add an additional 1 to 2 bcm to the trans-Atlantic LNG trade over the coming year,” the study states.

Despite the steady growth, the boom in exports from the US may not last.

“The EU’s appetite for U.S. LNG is far from guaranteed in the long run. Europe is certainly reeling from limited gas supplies in the short term. But the continent is responding mostly by cutting demand for gas, by using the fuel more efficiently while ramping up substitutes such as wind and solar. Those shifts are likely to last for the long haul, and are being supercharged both by high prices and by the continent’s ambitious climate goals, which call for major cuts in gas consumption,” the study states.

Europe has responded to the increase in LNG shipments by boosting its import capacity. European demand for LNG is expected to remain high for several years as the region’s economy adjusts to new supply lines for gas. Prices will remain elevated in Europe as well as the region buys from spot markets to make up for the loss of pipeline imports from Russia. Newly commissioned floating LNG terminals and more efficient use of existing gas pipeliens will ease shortages in eastern and central Europe, which heavily depended on pipeline imports from Russia.

The European economic think tank Bruegel has forecast that the reduction in European gas demand by 2030 could make most of the region’s new LNG import infrastructure unnecessary. “In short, the boom in U.S. LNG exports to Europe could be fleeting,” the study concluded.

The strong prices for gas in Europe and the progress of the global energy transition have restrained the growth in demand for LNG worldwide. “Companies that place their bets on decades of robust LNG demand could be setting themselves up to lose as much money in a coming bust as they’ve made during this year’s boom,” according to the study.

MAGAZINE

NEWSLETTER

CONNECT WITH THE TEAM