World markets see rising uncertainty amid conflict

18 March 2022

There is almost always some uncertainty about the outlook for the future direction of energy markets. The Russian invasion of Ukraine has sent the market for European gas into turmoil as the continent is rethinking its supply chain and renewing its quest for energy independence and lower emissions.

Gas supplies in Europe were tight and prices were strong even before Russia’s invasion of Ukraine. The continent’s drive for alternative fuels has also made the future of gas more uncertain. The European Parliament in December unveiled proposed revisions of its gas regulations, which are designed to lower emissions and speed along the transition away from hydrocarbons.

For now, however, Russia is one of Europe’s most significant energy sources, supplying 38% of its gas needs. Russia is the world’s third largest gas producer and the largest exporter, the International Energy Agency (IEA) reported.

In 2021, Russia exported 8.9 Tcf of natural gas, about 36% of the 24.8 Tcf of the gas it produced. About 84% of its exported natural gas reached its destination by pipeline. The rest was shipped as LNG. Europe was the largest destination. Germany, Turkey Italy, Belarus and France received most of that natural gas. China and Japan are also significant recipients of Russian natural gas, the EIA reported.

Should Russia cut off its natural gas exports entirely, the European Union said it expects LNG imports will play a “key role” in supplying markets. Norway and The Netherlands have some gas production, but cannot significantly increase output in the coming months, according to a working white paper from the European Parliament.

The region has a total annual LNG import capacity of about 156 Bcm, the largest share of this capacity lies in Spain, but the Iberian Peninsula’s connection to the rest of the European grid is limited. Other significant LNG importers include France, Italy, the Netherlands and Belgium, the EU said.

Policymakers in the region are keen to further reduce emissions even as they look for adequate supplies to heat homes and run industries.

“Nobody is under any illusions anymore. Russia’s use of its natural gas resources as an economic and political weapon show Europe needs to act quickly to be ready to face considerable uncertainty over Russian gas supplies next winter,” said Fatih Birol, executive director of the International Energy Agency.

Meanwhile, European officials have stressed the importance of reducing the region’s dependence on Russian gas. “In recent years, we have already significantly diversified our supply, building LNG terminals and new interconnectors,” said Kadri Simson, European Commissioner for Energy.

In response to the uncertainty surrounding international gas markets, the International Energy Agency announced a 10-point plan to reduce its imports of Russian natural gas by more than one-third within a year through a combination of measures that would still enable it to meet the terms of the European Green Deal and support energy security and affordability.

Those proposals include a ban on new gas supply contracts with Russia, the replacement of Russian gas with alternative energy sources, new wind and solar projects, the replacement of gas boilers and heat pumps. However, critics have pointed out that these policies are just proposals and even if implemented, it could take months for the policies to have an effect on European gas consumption.

Although European climate activists have called for a ban on all hydrocarbon production, many

European policymakers said they consider natural gas a necessary source of energy for the transition. Gas is cleaner than coal and can act as a buffer when power from sunshine or wind falls short, the EU has stated.

A large portion of Russian gas is transported to Europe via Soviet-era pipelines that go through Belarus and Ukraine. Nord Stream was finished about 10 years ago and has supplemented the capacity of those pipelines. The share of European gas that passed through Ukraine accounted for over 60% of Russia’s pipeline deliveries to Europe and the United Kingdom in 2009. By 2021, that total has fallen to 25% in 2021, the EU has reported.

Nord Stream and the recently-completed Nord Stream 2 pipeline run underneath the Baltic Sea to Germany, bypassing eastern Europe. Each pipeline has a capacity of 55 Bcm of gas per year. Nord Stream 2 is complete, but not authorized for operation.

Nord Stream1 is owned and operated by Nord Stream AG, which is based in Switzerland. Russia’s Gazprom owns a 51% stake in the project, while the rest is owned by German, Dutch and French energy companies. Nord Stream 2 is owned and operated by Nord Stream 2AG. Russia’s Gazprom is the sole shareholder.

US markets

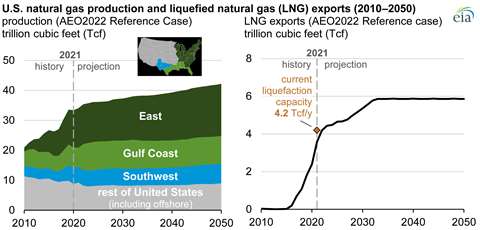

As Europe reassess its energy mix and energy infrastructure, the U.S. expects its gas consumption, production and exports to grow through 2050, according to the latest Annual Energy Outlook issued by the U.S. Energy Information Administration.

U.S. energy consumption is expected to grow over the next 30 years in a range of economic scenarios as the population and economic growth of the country grow faster than gains in efficiency in energy use, the EIA has reported.

U.S. gas production is increasingly driven by natural gas exports, which the agency expects to grow by almost 25% through 2050.

Despite the historic and expected growth in renewable fuels, the EIA said it expects petroleum and natural gas to remain the most-consumed sources of energy in the U.S. through 2050. The transportation sector will consume the majority of the fuels, particularly motor gasoline and diesel.

Production of renewable energy will grow more quickly than any other source through 2050. Consumption of natural gas will continue to grow over the next 30 years and will keep its place as the second-largest share of all fuel sources. Overall, natural gas prices will remain lower than historical levels, the EIA reported.

Meanwhile, incentives for the development of wind and solar technologies, and falling technology costs, will make for robust competition with natural gas as a fuel for electricity generation. Coal and nuclear power are expected to decline as a percentage of the U.S. Energy mix.

State and federal policies are expected to support the growth of renewable energy, primarily from wind and solar. “New technologies will continue to drive down the cost of wind and solar generators, further increasing their competitiveness in the electricity market, even as assumed policy effects lessen over time,” the EIA reported.

The EIA said its annual outlook uses several scenarios based on what might happen in the market over the coming years. In the reference case, the agency projected that U.S. natural gas exports will rise through 2050, driven by growth in three separate: the LNG export capacity, global gas consumption and pipeline exports to Mexico and Canada.

The reference case includes the agency’s baseline assumptions about technology, policy and the economy through 2050. The reference case assumes that energy efficiency will increase, which will slow the growth of domestic U.S. consumption.

In 2021, U.S. natural gas exports reached 9.7 Bcf/d, a record high and an increase of 50% from the previous year. The EIA projected ongoing growth in natural gas exports through 2025 as LNG projects currently under construction come online. Export facilities at Sabine Pass, Calcasieu Pass and Golden Pass will likely enter service much earlier than anticipated in previous outlooks. Additional pipeline infrastructure into Mexico will also boost exports in the coming years, the EIA reported.

Beyond 2025, the EIA anticipates that natural gas production will increase to meet ongoing demand for exports, primarily through LNG. “We project global demand for U.S. natural gas to exceed current and announced LNG export capacity,” the EIA stated. “Therefore, additional LNG export facilities will be economical to build. These LNG capacity expansions, coupled with high demand for natural gas abroad.”

The EIA projected that LNG exports will increase to 5.86 trillion cubic feet (16.1 Bcf/d) by 2033 in its reference case. This, in turn, will encourage ongoing growth in U.S. production. More than half of projected U.S. natural gas production growth will come from associated gas produced from tight oil reservoirs.

Shale gas and associated natural gas from tight oil reservoirs are expected to be the primary contributors to long-term growth of U.S. natural gas production through 2050. A large portion of that additional production will come from the Wolfcamp in the Permian Basin, the Marcellus, Utica and the Haynesville basin.

Despite the expected growth in LNG exports and the growth in domestic demand, the EIA predicted the price of Henry Hub will remain below $4/MMBtu for most of the future in most scenarios envisioned by the EIA.

The oil and gas supply cases indicate that the price at Henry Hub is very sensitive to reduced supply and a little less sensitive to increased supply. In the latest International Energy Outlook 2021, the EIA projected global natural gas consumption to continue growing through 2050, in both absolute and relative terms. The growth comes in part from its economics and lower carbon emissions relative to other sources of energy, the EIA reported.