EIA survey sees weaker gas prices in ‘22

09 September 2021

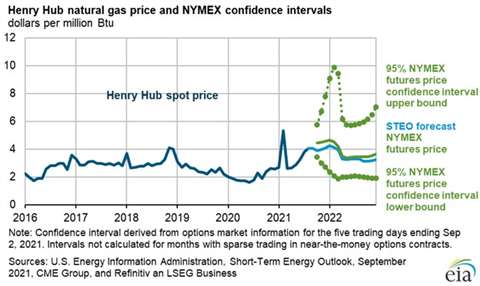

U.S. natural gas prices should soften moderately to around $3.47/MMBtu in 2022, the U.S. Energy Information Administration (EIA) predicted in its latest short-term energy outlook. Natural gas prices should ease as production climbs and export growth slows next year, according to the forecast.

Natural gas spot prices at Henry Hub averaged $4.07/MMBtu in August, up from $3.84/MMBtu one month earlier. The increase was caused by warmer temperatures throughout the U.S., which lead to a greater demand for electrical power fueled by natural gas. Hurricane Ida caused a decline in natural gas production in the U.S. Gulf of Mexico, leading to a further increase in late August.

The spot price for gas in August was $1.77/MMBtu higher than one year earlier. The increase in prices stems from a growth in liquefied natural gas exports, rising domestic natural gas consumptions for sectors outside of the electric power sector and generally flat natural gas production, the EIA reported.

The EIA forecast price for gas in 4Q2021 was about $4.00/MMBtu and $4.25/MMBtu for January 2022. From there, prices should slide as U.S. production grows and LNG export growth slows in 2022, the EIA predicted.

Hurricane Ida pushed more than 90% of natural gas production in the Gulf of Mexico offline in late August, when monthly production fell to 1.9 Bcf/d, down 0.4 Bcf/d from July. The EIA forecast that GOM production will gradually come back to normal in the first half of September and average 1.5 Bcf/d for the month before returning to an average of 2.1 Bcf/d in 4Q21.

The EIA said it expected dry natural gas production to average 92.7 Bcf/d in 2H21, up from 91.7 Bcf/d in 1H21. Looking forward to 2022, production is expected to climb further to 95.4 Bcf/d, as gas and oil prices should remain strong enough to support a growth in production.

Total gas consumption expected to fall

Total U.S. gas consumption is expected to average 82.5 Bcf/d in 2021, down 0.9% from last year. Consumption is expected to fall primarily because some electric power generators have switched to coal in response to higher natural gas prices.

But the EIA added that consumption among other sectors outside of power producers should expected to climb this year. Residential and commercial natural gas consumption will rise by 1.2 Bcf/d from last year, while industrial production will rise 0.6 Bcf/d, the EIA predicted. Climbing gas consumption in sectors other than the electric power sector is caused by an increase in economic activity and colder winter temperatures from 2020. For 2022, natural gas consumption is expected to average 82.6 Bcf/d, essentially unchanged from 2021.

Natural gas inventories in the U.S. ended August 2021 at 2.9 Tcf, about 7% lower than the five-year average for this time of year. One reason for the lower inventories is that injections into storage over the summer have been lower than usual – in turn caused by hot summer weather and a surge in exports, the EIA reported.

The agency forecast that U.S. inventories will reach 3.6 Tcf by the end of October (the end of the injection season), about 5% below the five-year average for this time of year.

The EIA’s latest short-term energy outlook assumes that U.S. GDP will grow by 6% in 2021 and by 4.4% in 2022. The agency cautioned that the outlook remains subject to the uncertainty about the ongoing recovery caused by the COVID-19 pandemic. The macroeconomic assumptions in its outlook are based on forecasts by IHS Markit. The forecast assumes continuing economic growth and growing mobility.